Have you watched “Bridget Jones’s Diary”? The famous scene when Bridget is singing “All By Myself” comes to mind when I reflect on the question of debt sustainability in African countries.

Although it is a song about loneliness, the title seems fitting in the case of African economies, some of which are maturing and trying to ‘go it alone” while, at the same time, still maintaining the option to dial the International Monetary Fund (IMF) “helpline” if needed.

I flew to Nairobi and Luanda in December 2025, to explore a simple yet profound question: can African nations maintain debt sustainability without the IMF’s safety net?

With the exception of Botswana and, more recently Nigeria, the majority of Sub-Saharan African sovereigns rely heavily on IMF assistance and funding in order to ensure fiscal discipline and debt sustainability.

However, more recently, a number of countries, including Kenya and Angola, have not renewed their IMF programs.

These countries are pursuing a different approach: is there a fundamental shift in the way emerging market debt is being managed?

Over the last year Kenya has outperformed its high yield peers by delivering a total return of close to 25% in its 2034 eurobonds, with spreads compressing to below 500bps over US Treasuries for 10-year paper, implying a high probability of an upgrade to single B. Performance of Angola’s sovereign debt has somewhat lagged, fuelled by concerns regarding oil dependency, with the sovereign trading around 600bps spread, offering just below double-digit yields for 10-year paper at the end of 2025. We believe that, while in the short-term Kenya might continue to outperform, investors might be over-penalising Angola given its solid fiscal stance.

Indeed, walking through Luanda's financial district, it's difficult to believe this is a country that many investors wrote off in 2020, when debt-to-GDP peaked at 119%. Angola has quietly become one of Africa's compelling debt sustainability stories, although you wouldn't know it from the headlines or from the level of the government’s public engagement.

With debt-to-GDP sitting just above 60% – within sustainable territory – and foreign exchange reserves covering eight months of imports, Angola has achieved stability post the completion of its most recent IMF lending program in 2021. Despite its oil dependency, Angola has been complying with the Fund’s recommendations. The country has taken positive measures (albeit aided by strong oil prices), maintaining buffers to manage its ongoing liquidity challenges, including a sovereign wealth fund ($3bn) to capture oil windfall, reducing its reliance on China’s funding, executing some key fiscal reforms, and implementing a new law on central bank independence.

The secret sauce? Disciplined deleveraging, primary fiscal surpluses and gradual diversification. Angola has systematically reduced its exposure to Chinese oil-backed loans from US$19bn to a more manageable US$8bn of oil guaranteed loans, or 13% of total debt, with the view to repay them fully by 2028. The country is also building its domestic capital market, with close to 40% of government borrowing (or US$7bn out of US$15bn) in 2026 expected from the domestic market. The Lobito Corridor infrastructure project, connecting Angola's ports to the mineral-rich Democratic Republic of Congo, represents the kind of forward-thinking investment that could transform Angola into a strategic logistics hub for rare minerals and other goods. The fiscal anchor has been key for Angola, with the fiscal deficit currently a modest 3.3% of GDP or US$4bn. Of an expected $7bln external financing plan, of which US$3-4bn is already prefunded for 2026, Angola expects to cover the balance via bilateral, multilateral and market sources.

However structural vulnerabilities are still present. Oil remains king; the current account breakeven is around $65 per barrel, leaving little room for price shocks. We met some foreign owned oil companies that operate in Angola, to get their take. It was pleasing to hear that their shareholders view Angola as best-in-class amongst EM countries when it comes to stability of the fiscal terms. The state-owned energy company is also operating as a reliable partner with other oil majors, as well as investing in the downstream business to reduce Angola’s reliance on fuel imports.

In our view, Angola needs to increase the depth of its domestic market to further reduce external vulnerabilities. Despite high policy rates at 17.5% and a downward trend in inflation at 16%, the local market is not attracting foreign players because the parallel FX market is trading at a 15% premium to official rates, and they are further deterred by the significant backlog of USD demand (up to US$500mm). Daily liquidity is poor at US$50mm. Opening capital accounts and implementing pensions fund and insurance reforms to increase this segment of the domestic market would be key steps to deepening this funding avenue.

"The challenge is also governance and communication," admitted one senior official during our trip, requesting anonymity. "We have good technocrats, but we need 200 more." This is a candid acknowledgment of the institutional weaknesses that could potentially derail Angola's progress, as political pressures mount ahead of 2027 elections.

Kenya, in contrast, resembles an ambitious trapeze artist performing without a net. The country has achieved remarkable macroeconomic improvements – inflation is down to 4.5% from double digits, the current account deficit has narrowed to 2% from 5%, and episodic foreign exchange shortages have been eliminated. Yet it faces substantial annual gross financing needs of US$14bn against a backdrop of a deteriorating fiscal stance. The fiscal deterioration is worrisome, with Kenya’s fiscal deficit expected at 6% of GDP, or almost US$9bn, versus the government’s target of 4.8%. This issue is a challenge, partly because of high interest payments that account for 30% of government revenues (or US$4.5bn), but also because a primary deficit of -0.5% is unsustainable in the medium term against close to 70% debt to GDP, even with a GDP growth rate of 4%+.

The numbers tell a story of both success and strain. The country has been very effective in diversifying its funding base and reducing the cost of funding where possible. It has further deepened its local market with close to 20% of total debt and 35% of domestic debt being held by local banks. Insurance companies and pension funds are also meaningful domestic players. Retail investors have increased their participation, now holding 6% of government debt – up from just 2% before the recent reforms. Remittances flow in at US$5 billion annually, while planned asset sales including US$2bn from the sale of safari.com, additional proceeds from the KPC IPO and further divestments should be complemented with a possible World Bank disbursement of US$1.3bn, additional market issuance and a US$1bn UAE credit line that may be drawn. This should be enough to address external liabilities of approximately US$7bn due in 2026. The cost of external debt should not increase substantially with over 50% of it being financed by multilateral development banks. Moreover, Chinese debt restructuring has provided some relief, with US$3.5billion reprofiled estimated to save US$215mm annually, by swapping payments into yuan whilst a fresh grace period and maturity extension were agreed, demonstrating Beijing's evolving approach to African debt distress.

Kenya has also turned to increasingly creative financing mechanisms. The government has securitised the fuel levy, the road maintenance levy and football stadiums, raising close to US$2bn, while technically keeping these obligations off the balance sheet. FX reserves of US$12bn, with over five months of import cover, also provide a buffer.

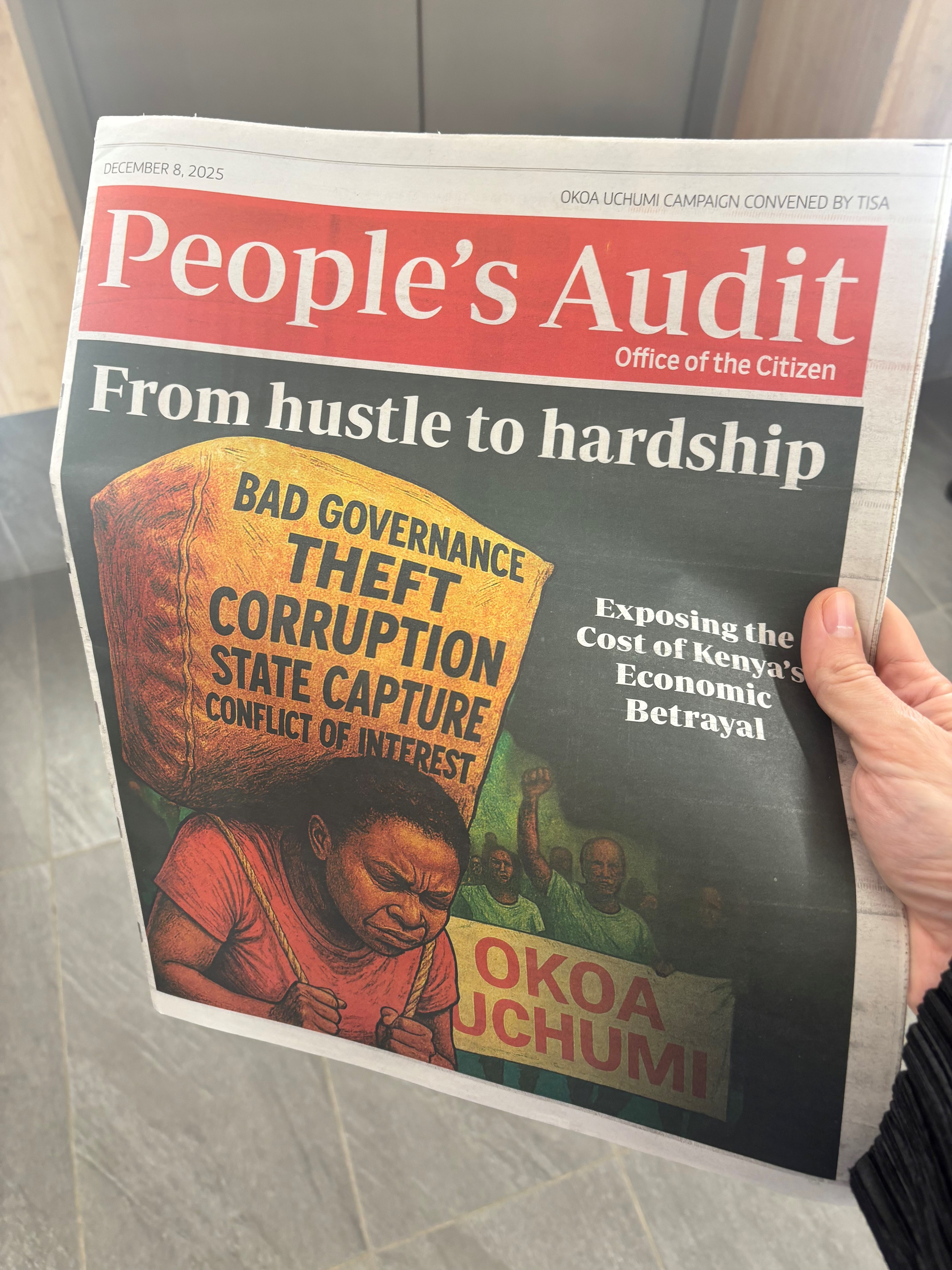

Yet, Kenya continues to struggle with reining in its fiscal deficit. This was further complicated by the June 2024 protests that forced the government to abandon tax increases and also severed the country's relationship with the IMF. Policymakers are, on the one hand, reluctant to bring back the IMF due to its unpopular fiscal policies but, on the other hand, appear unable to implement the prudent measures themselves, especially ahead of 2027 general elections. Some initiatives, such as the introduction of an electronic government procurement system should be low hanging fruit, potentially yielding meaningful savings to the budget of US$1.3bn, given that half of the budget, or US$16bn, is spent on goods and services. Nevertheless, even these measures seem to be difficult to implement.

The issue of social disconnect stems from widespread corruption, and results in slow progress in improving public infrastructure as well as in providing social safety nets, despite the ongoing tax increases. Given that Kenya’s tax regime is already amongst the highest in the region, with personal income tax at 38%, there is limited room to increase the tax burden further. Widening the tax revenue base would be important, given only 5 million (instead of 20 million) out of 55 million people in Kenya are paying taxes. That said, the poor level of infrastructure and social support is a large impediment to joining the official workforce.

The lesson is clear: markets remain willing to work with African borrowers who demonstrate genuine commitment to reform and fiscal discipline. However, this requires a level of institutional capacity and political consensus that not all countries possess.

An interesting development reshaping African debt dynamics is also emerging from the Gulf states. Middle Eastern financial institutions are expanding their presence across Sub-Saharan Africa, offering an alternative to traditional Western donors and Chinese lenders.

Kenya's $1.5 billion credit facility from UAE institutions exemplifies this trend. Unlike IMF programs, which come with extensive conditionality, Gulf financing often focuses on strategic partnerships and infrastructure development. The approach reflects these nations' own development experience –rapid modernisation funded through commodity revenues and strategic investments.

The Gulf region continues to be over-banked, with the UAE alone having 40 banks against a 10 million population. This could create opportunities for African partnerships. With oil prices expected to remain subdued over the next 2-3 years, some Gulf states are open to diversification opportunities – and African infrastructure could present an attractive option. Unlike traditional aid, which often focuses on poverty reduction, Middle Eastern financing targets commercially viable infrastructure that generates returns. The Lobito Corridor, connecting Angola to central Africa's mineral wealth, could represent the kind of connectivity project that Gulf investors understand, but we would need more projects like this going forward.

Can African countries maintain debt sustainability without the IMF, beyond the pre-election break? The evidence suggests a qualified ‘yes’, but success requires, amongst other items, a deepening of the local markets and a fiscal anchor.

Angola's path relies on commodity discipline and gradual market development. The country's lower debt ratios and adequate reserves provide breathing room, while successful reduction of Chinese exposure demonstrates genuine deleveraging. However, heavy oil dependency remains a critical vulnerability and further diversification of the economy and local market development are key to its graduation from the IMF assistance. Kenya's diversified economy and financial market depth offer stronger long-term fundamentals, but immediate liquidity pressures and lack of fiscal discipline require careful navigation. Can the government prioritise delivery on its social and infrastructure promises, while maintaining fiscal discipline? Poor governance, spending inefficiencies and widespread corruption need to be addressed in order to achieve a structurally different, sustainable growth model going forward.

What emerges from our analysis is a picture of evolving debt sustainability that transcends the traditional Washington consensus. African governments are increasingly sophisticated in their approach to debt management, utilising domestic capital markets, strategic partnerships, and innovative financing mechanisms to maintain stability.

In fact, the critical question isn't whether countries like Kenya and Angola can avoid debt distress – it's whether they can achieve sustainable growth while managing their debt burdens. Both possess the technical capabilities for effective debt management; the challenge lies in maintaining political commitment to necessary reforms while preserving social stability. The potential reward for investors and policymakers is significant: Kenya trading at high single-digit yields while Angola is currently borrowing at close to double-digit yields. These yields could rally by as much as 100bps to reach levels of single B rated Ghana or, as much as 200bps, if they were to migrate to the BB rated status of South Africa.

Traveling to these destinations is also becoming a more pleasant experience with improved intra-regional connectivity, as we took a recently launched direct flight from Nairobi to Luanda. My favourite part of the trip was a meal at Luanda’s local restaurant where the variety and quality of local dishes, with Portuguese heritage, was on a par with the top restaurants in the world. Sitting by the beach restaurant, just moments away from the financial district, before taking a taxi back to the airport, it occurred to me that perhaps Eddie’s Money song “Two Tickets to Paradise” was a more appropriate acoustic setting than Jamie O’Neil’s rendition of “All By Myself”.