Tom Mowl, Portfolio Manager, BlueBay Asset Management, discusses how capital preservation should be at the center of any fixed income investment strategy. Here’s how BlueBay assesses credit protection in securitized products.

We are always asking ourselves the question – what will it take for our investment to be fundamentally impaired?

Along with other questions, such as what is the mark-to-market risk and expected liquidity, these form the basis of our investment process.

What will it take for our investment to be fundamentally impaired?

Broadly speaking, the answer is that today’s securitisations markets are very conservatively structured and the collateral is tightly underwritten, resulting in a large cushion against potential defaults.

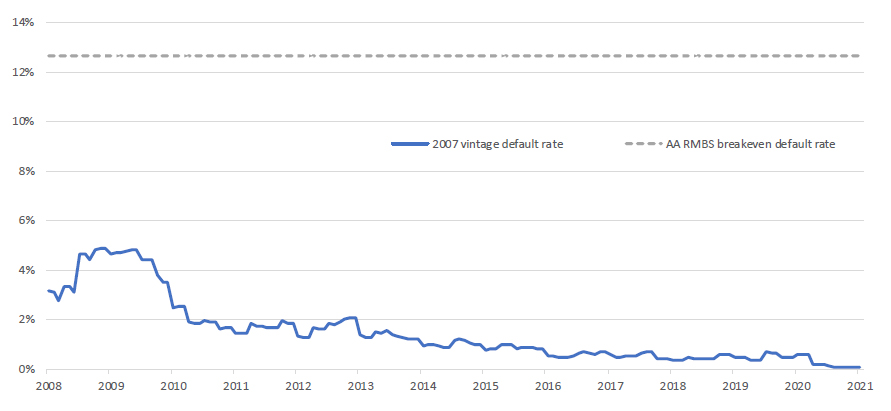

Using an example from the residential mortgage-backed securities (RMBS) sector, chart 1 overleaf provides a visual representation of today’s market environment. The dotted grey line shows the flat default rate on the underlying pool of mortgages required before a typical AA-rated UK mortgage bond is impaired. The blue line shows the historical default rate for a representative pool of UK nonprime mortgages originated in 2007 – the weakest vintage historically.

Chart 1: RMBS Default Analysis

Source: Moody’s, Intext, BlueBay Asset Management, July 2021

Defaults would have to reach 2.6x the peak of defaults seen in 2007 and remain there forever to impair the investment (or in cumulative loss terms, be over 5x larger than the 2007 vintage) – something we think is extremely unlikely given the quality of the mortgages today and provides the basis for our positive view on fundamental risks in RMBS markets.

How is this level of risk remoteness achieved?

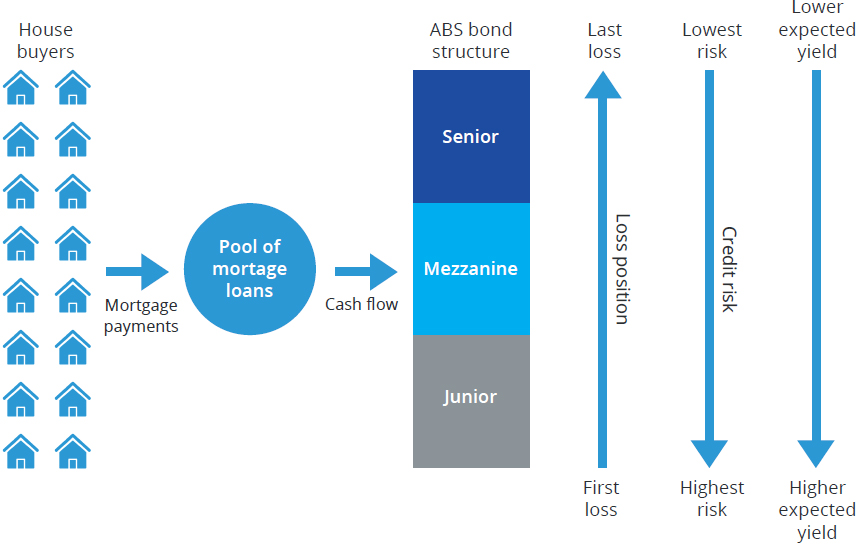

Let’s take a step back to remind ourselves how asset-backed securities (ABS) work. As chart 2 shows, an ABS is created by pooling collateral (in this example, we are using mortgages), with the cash flow from the collateral going to pay the various tranches and losses being allocated from the bottom up.

Chart 2: Investors' Differing Risk/Return Profiles

The first protection, in mortgage bonds at least, is provided by borrowers’ equity in the property before you even consider the ABS structure. Loan-to-value ratios of the underlying mortgage collateral typically range from 60–75% – with the borrower making a 25–40% down payment – meaning that on default of the mortgage, the first loss is taken by the borrower.

If property prices have fallen sufficiently, resulting in the loss being higher than the equity amount, then the losses start to be allocated bottom-up to the ABS structure.

Post the global financial crisis, the size of subordinate bonds in the capital structures increased, as rating agencies and investors became more conservative – in some cases, the AA tranches have twice as much subordination now. This has led to the situation today where investment grade-rated bonds have a large cushion to defaults and are well positioned to absorb losses from potential future default cycles – especially considering the underlying collateral is also of higher quality.

After getting comfortable with the credit profile of a bond, the next steps in the investment process are to look at the spread on offer and the potential for mark-to-market volatility. ABS currently offer a significant pick-up in spreads, short-weighted average lives to limit mark-to-market risk and are floating-rate bonds – protecting against the potential for rising interest rates. Different collateral types (mortgages, consumer loans, corporate loans etc) and bond seniority then provide exposure to different risk factors and return profiles, allowing investors to build high-quality diversified portfolios.

All in all, this provides what we believe to be a compelling investment opportunity.

View the print version here.