During 2021, investors were surprised at how long-dated government bond yields proved firmly anchored at very low levels – even as economies recovered from the shock of the 2020 pandemic recession. This occurrence was even more notable against a backdrop of strong inflation, which central bankers now fear is less transitory than originally expected.

With ultra-low long-dated yields supporting elevated price/earnings multiples, the question central to all investors is whether this low-yield regime can persist.

On one hand, some may argue that the natural level of interest rates has been on a declining trend for several years, citing a long-term thesis of secular stagnation. Yet, with little evidence of a slowdown in technological progress (look at how quickly new vaccines are currently being developed), it seems odd that this thinking should hold sway in bond markets.

On one hand, some may argue that the natural level of interest rates has been on a declining trend for several years, citing a long-term thesis of secular stagnation. Yet, with little evidence of a slowdown in technological progress (look at how quickly new vaccines are currently being developed), it seems odd that this thinking should hold sway in bond markets.

This thesis also contradicts elevated growth expectations regarding future corporate earnings.

On the other hand, secular stagnation is characterised by a shortfall in demand relative to supply. Currently, the reverse of this is true, with supply incapable of keeping pace with demand. Moreover, a paradigm shift towards more expansive fiscal policy and demand management may infer that secular stagnation is unlikely to take hold – especially if policymakers observe they can spend money freely without facing any consequences.

Instead, it could be that government bond yields have been temporarily anchored by an abundance of liquidity over the past couple of years and that as the monetary cycle turns, so investors should be more fearful of higher yields.

From this perspective, it is possible to observe the tectonic plates on which yields are supported, starting to shift. Indeed, it may not be an exaggeration to wonder if an earthquake in yields could fundamentally reshape the financial landscape in the months to come.

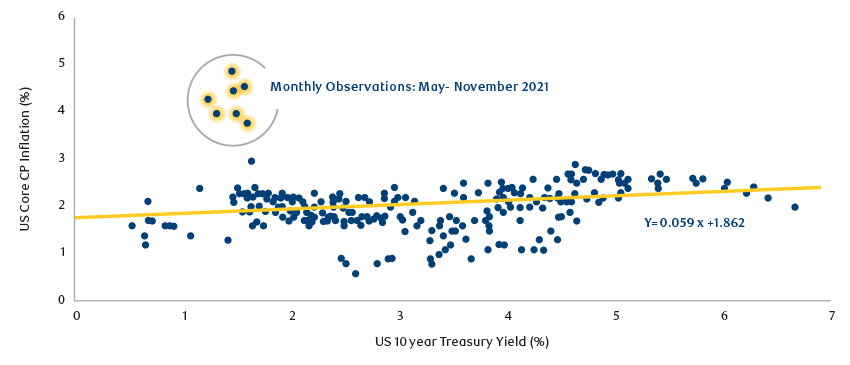

US bond yields & inflation between 2000 & 2021

Source: Bloomberg, January 2022

Is a yield earthquake coming? | 2 Just as seismologists study history to predict future earthquakes, historical data suggests that yields are materially out of alignment and are overdue adjustment.

The chart highlights the anomaly between prevailing inflation and bond yields. Meanwhile, higher CPI is leading to a de-anchoring of inflation expectations, causing secondary impacts.

With labour markets tight, wages are moving higher. Unions, whose members have seen real wage cuts, are gearing up for industrial action, pushing for double-digit pay claims in 2022. Although goods price inflation should decline after Easter, as base effects and supply disruptions ease, higher wages and service price inflation should mean that inflation remains considerably above central bank targets.

Inflation is now attracting more attention from policymakers, and central banks may be increasingly pressured to withdraw monetary accommodation in the coming months.

Yet, with interest rates very negative in real terms, policy may need to be tightening materially before it reaches a neutral point, let alone becomes restrictive. This was seenbetween 2003-07, when the US Federal Reserve hiked rates at every meeting, yet was blamed for overly easy monetary policy contributing to the global financial crisis. Hence, higher central bank rates may be something of a persistent headwind for yields for quarters to come.

And expansive fiscal policy could compound this. Higher deficits equal higher bond issuance and with austerity out of favour, fiscal policies can also reshape the yield landscape.

So, is an earthquake in yields coming? Possibly, yes.

If it does happen, then there is a good chance it will occur in 2022. In that case, long-duration assets may be vulnerable to a material correction. Shorter-dated assets look like a safer home for capital against this landscape. There remain opportunities in the credit markets if you are able to avoid the landmines. In equity markets, a rotation towards the asset class, and specifically sectors such as European bank stocks, could make it a compelling place to be.

View the content as a pdf here.

Related: 2022 outlook: Inflection point