Impact investment themes

Our approach to impact investing seeks to build a sustainable ecosystem by investing in People, Prosperity, and Planet. To that end, we’ve identified seven key themes that we target with our investments.

Using these themes we’re able to build portfolios designed to deliver competitive financial returns while also driving targeted, measurable impact.

Supporting underserved and marginalized communities

Investments to impact society

Investing in People means investing to improve society for individuals or populations who are disadvantaged, vulnerable, marginalized or underserved in a fundamental way, either socially or economically. Our impact investing strategies have a long-standing history of supporting Low-to-moderate income and marginalized communities and individuals.

Our investments in People help to build stronger communities by providing equal access to safe, affordable housing, quality education and healthcare services which are critical for promoting well-being and creating resilient and sustainable societies.

Find current examples of our investments in people on the Education, Health & Wellness and Multi-family Affordable Rental Housing tabs on our impact examples page.

Aligned with UN SDG Goals

Promoting upward economic mobility

Investing in a sustainable economy

Economic mobility is fundamental to the American dream. Affordable housing and entrepreneurship are key drivers to building wealth, but many populations still do not have equal access to these opportunities.1

Our investments in Prosperity help build wealth through homeownership and by supporting small businesses. We target our investments in BIPOC and other underserved communities to support sustainable growth.

Find current examples of our investments in prosperity on the Affordable Homeownership and Small Business tabs on our Impact Examples page.

1Source: https://www.pewtrusts.org/eng/projects/archived-projects/economic-mobility-project

Aligned with UN SDGs

Promoting environmental sustainability

Investments to promote the health of the environment

A safe and healthy environment is inextricably linked to other benefits including job creation, public health and poverty reduction. There are also significant economic consequences associated with climate change such as crop viability, insurance and property risk and real estate trends.

Our investments in planet seek mitigate climate risk by investing in projects that promote:

- Renewable energy

- Clean air and water

- Land preservation

- Efficient resource use

- Environmental remediation projects

Find examples of our investments in Planet on the Clean Water & Sanitation and Climate Change Solutions & Mitigation tabs on our impact examples page.

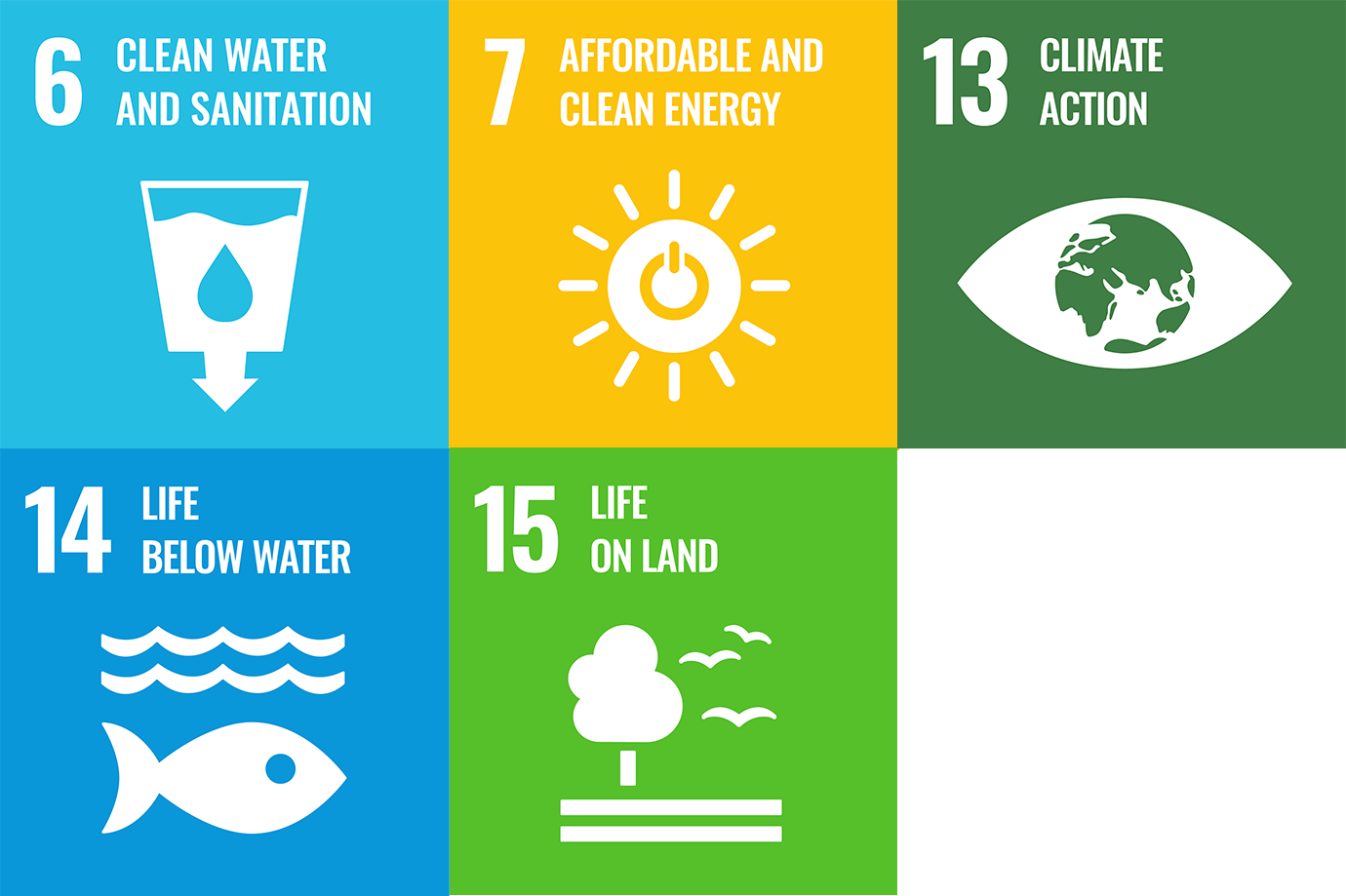

Aligned with UN SDGs