An RBC Global Asset Management partnership with Minnesota Council on Foundations

Providing a coordinated approach for investors to make market-rate investments to impact Minnesota with a focus on underserved communities and families.

Founding Sponsor

The Purpose of MI3

MI3 is a collaboration of investors led by the Minnesota Council on Foundations, created with strategic support from Cogent Consulting. MI3 is dedicated to building support for impact investment strategy targeting communities in need in Minnesota.

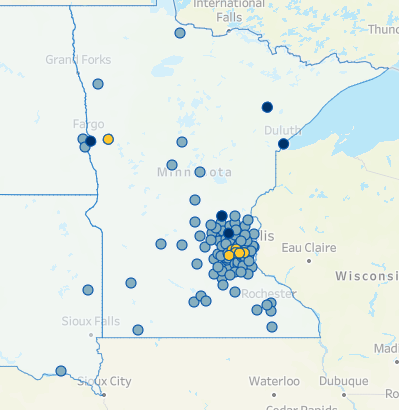

MI3 participants include large and small foundations, local government agencies and individuals. Participants set out to catalyze the growth of impact investing in Minnesota through a coordinated investment to build capacity and scale. These projects support home ownership, job creation, small business growth, and increased access to rental housing, healthcare, and education in Minnesota.

Investing for Impact at RBC Global Asset Management

Through the partnership with RBC Global Asset Management (RBC GAM), participants in MI3 can invest in high quality, liquid fixed income strategies intended to create positive social and environmental impacts while also seeking a competitive financial return. RBC GAM believes that we can help build stronger communities and build portfolios of high quality securities that meet investors' needs while increasing the flow of capital to designated communities.*

*Participants' ability to designate geographies and/or themes is dependent on the amount of their investment and the vehicle through which they invest.

Custom mandates also available. Please contact us to learn more.

Disciplined investing with a Community Development Purpose through the Access Capital Community Investing strategy

- High quality, liquid fixed income investment strategy that primarily holds investments guaranteed by the US government, its agencies or municipalities

- 25+ year track record delivering social impact and institutional caliber investments

- Advances social justice in market-rate investments through the creation of customized securities that support underserved people in the US

- Builds stronger communities by financing affordable housing, job creation, healthcare, education and infrastructure projects that foster sustainable economic development

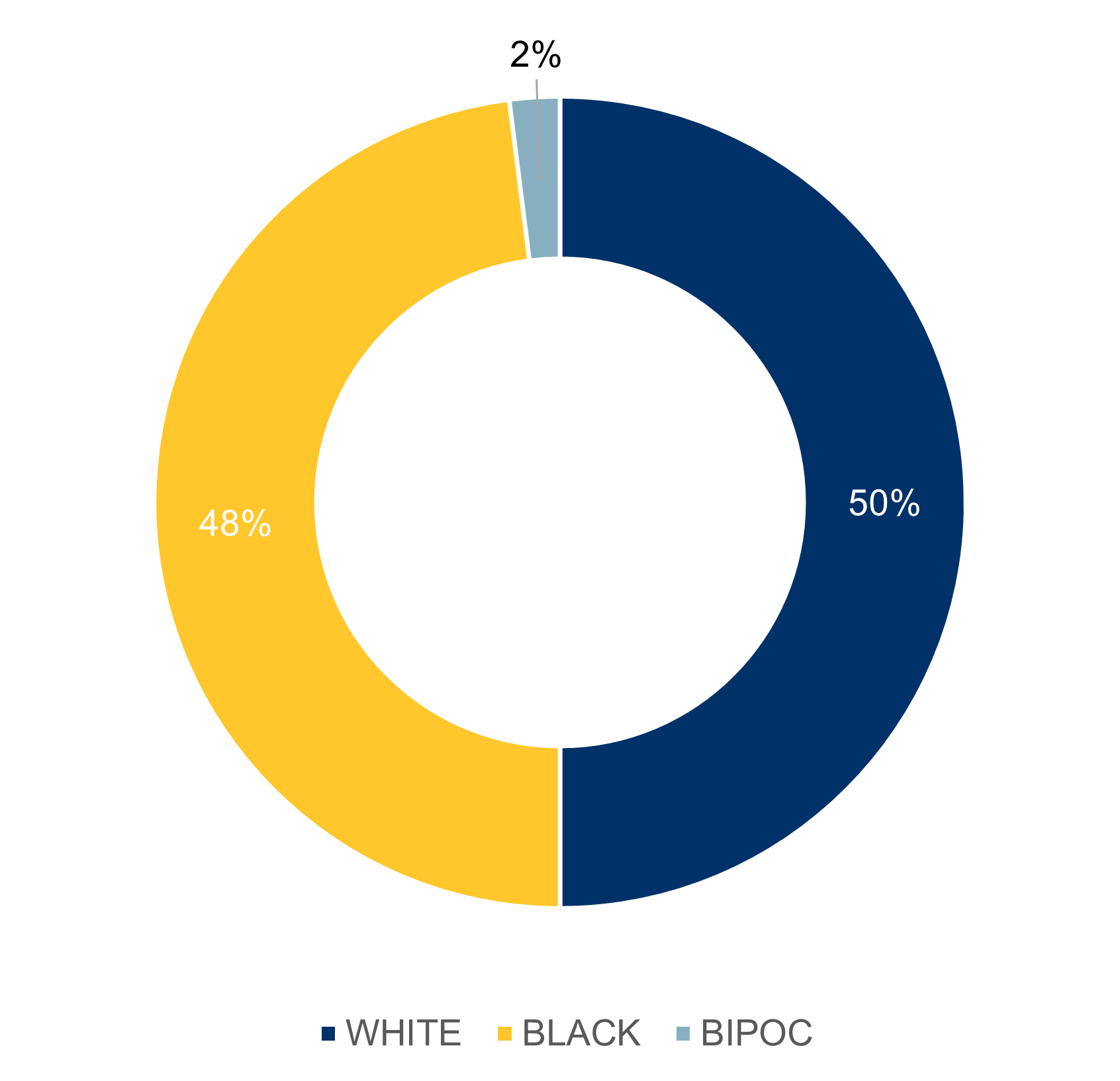

100% |

of units at or below 80% Area Median Income |

50% |

of properties are located in BIPOC neighborhoods |

76% |

are women-headed households |

15.5% |

average annual income of residents |

*Figure represents the weighted average of all neighborhood residents across census tracts in which the properties are located.

Note: Subsidized housing resident data is only available for assisted housing subsidies under the following HUD programs: public housing, tenant-based, and privately owned, project-based; Data is provided by the U.S. Department of Housing and Urban Development

- 538 Units financed

- Investors include 8 foundations and 2 counties

*BIPOC is an acronym that stands for Black, Indigenous and People of Color. A loan is categorized as supporting a BIPOC neighborhood if >50% of the residents are BIPOC. Summary represents a shareholders’ specific allocation within DTR (Designated Target Region). Tenant profile data is presented for borrowers where data is reported. Where data is unavailable, the tenant is excluded from the calculation. Data available on 5 properties.

Source: RBC GAM, as of 6.30.25

Click for more details

Real world impact

Access Capital has contributed to impact investments in 50 states and the District of Columbia. Highlights include:

■ 22,291 low-to moderate-income home buyers ■ 109,638 affordable rental units ■ 6,071 nursing home facility beds ■ 27 rural properties ■ 101 rural enterprises ■ 1,546 small business loans ■ 149 community economic development projects ■ 17 community‑based not‑for‑profit organizations

Impact investments listed above include investments in all vehicle options for the BlueBay Access Capital Community Investing Strategy.

Addressing the needs of Minnesota

Homeownership

Owning a home has long been a pillar of the American dream. But would-be homeowners who are low-and-moderate income are often overlooked by the banking industries, even those with good credit. RBC GAM's impact investing strategies help low- and moderate-income home buyers access mortgages at prime rates and open the door to their own home.

Affordable mortgages for low-to-moderate income families provide stability, and are a major vehicle for building wealth and economic opportunity.

Rental housing

Across America, rental housing stock is severely limited and often overpriced. 80% of low-income households pay more than 1/3 of their income for rent, leaving less for food, healthcare and education. RBC GAM's impact investing strategies finance affordable rental units, buying first mortgages of multifamily rental units, helping to support renters with income limits, who are further supported by federal, state and housing authority assistance programs.

Small business

and job growth

Would-be small business owners often lack the capital to open businesses that serve the community, like laundry facilities, supermarkets and clinics. RBC GAM's impact investing strategies buy the guaranteed portions of SBA loans to deliver more services to the residents of low- and moderate-income communities and provide more job opportunities within the local economy.

Education

Access to quality education is a key driver of upward socioeconomic mobility and helps to reduce inequalities often found in higher education and the job force. RBC GAM’s impact investing strategies support equal access to educational opportunities, including preschools and primary schools, secondary and post-secondary education, as well as access to job skills and training programs. These opportunities are vital to students of all ages as they provide preparation for employment and career development.

Healthcare

Lack of access to comprehensive, quality healthcare services impacts the ability of men, women and children to lead healthy and productive lives. RBC GAM's impact investing strategies invest in a range of healthcare facilities in underserved communities --including nursing homes, community clinics, skilled nursing care and family dentistry --resulting in healthier, more stable and more productive communities.

Environmental

sustainability

Climate change is a global challenge that will have impacts on economies, markets, and societies worldwide. RBC GAM's impact investing strategies support projects that promote the health of the environment, including renewable energy, clean air and water, land preservation, efficient resource use, and environmental remediation.

SMALL BUSINESS LOAN TO MACHINERY MANUFACTURER, Princeton, MN

WALKER ON KENZIE – Affordable Senior Living, St. Anthony, MN

BIPOC-OWNED AUTISM TREATMENT CENTER, Minneapolis, MN

Solutions for making and measuring impact

| Geographic designation |

Thematic designation |

Individual DTR report1 |

MI3 report2 |

|

|---|---|---|---|---|

| Access Capital Community investing | ||||

| Separate account (≥ $50 million) | Yes | Yes | Yes | Yes |

| Mutual Fund3 | At ≥ $100,000 | No | At ≥ $1 million | Yes |

| Impact Bond | ||||

| Separate account (≥ $50 million) | Yes | Yes | Yes | Yes |

| Mutual Fund3 | No1 | No | No | Yes |

| Customized separate account (≥ $50 million) | Yes | Yes | Yes | Yes |

2 A report detailing the underlying loans in each security RBC GAM invests in on behalf of MI3.

3 For Mutual Fund information, please visit intermediaries.rbcgam.com/us/